SEBI has proposed a New Asset Class to bridge the gap between Mutual Funds (MFs) and Portfolio Management Services (PMS). This proposal, detailed in a consultation paper released on July 16, 2024, introduces a new product category designed for investors with investible funds between ₹10 lakh and ₹50 lakh, offering higher return potential compared to traditional mutual funds.

Table of Contents

- Introduction

- Background and Rationale

- What is an Asset Class?

- What is a New Asset Class?

- Introducing new asset class to bridge the gap between Mutual Funds and PMS

- Eligibility Criteria for Mutual Funds/AMCs to offer products under new asset class

- Registration and Approval Requirements under New Asset Class

- Minimum Investment Threshold under New Asset Class

- Defining the structure of the New Asset Class

- Branding and Advertising for New Asset Class to ensure clear distinction from traditional Mutual Funds

- Proposed relaxations to the investment restrictions for New Asset Class

- Investment in derivatives allowed for market exposure under the New Asset Class

- Conclusion

1. Introduction

Are you looking for an investment option that is a hybrid of the Mutual Fund and Portfolio Management Services (PMS), combining the best features of both? SEBI’s latest proposal might be just what you need. On July 16, 2024, SEBI released a Consultation Paper on ‘Introduction of new asset class or product category’ designed to offer more flexibility, higher returns and better investment protection. This innovative proposal aims to bridge the gap between MFs and PMS. With the flexibility in portfolio construction and the potential for higher returns, this new asset class can significantly enhance your investment journey. Comments may be submitted by August 6, 2024. Read on to learn how this new asset class can benefit you and make your investment journey smoother and more rewarding.

2. Background and Rationale

The investment management landscape in India has evolved significantly, with SEBI adopting a risk-based regulatory approach to diversify investment avenues while protecting investors. The current investment products include Mutual Funds, portfolio management services (PMS), and Alternative Investment Funds (AIFs), with increasing flexibility and minimum investment sizes from MFs to AIFs.

Over the years, an opportunity for a new asset class has emerged between MFs and PMS. The absence of such a product has pushed investors towards unregistered schemes, leading to financial risks. A new asset class would provide a regulated investment option for this segment, offering greater flexibility and higher risk-taking capability with risks mitigated by a higher minimum investment size.

3. What is an Asset Class?

In the financial markets, the term “asset class” refers to different categories of available investments, such as stocks, bonds, and real estate. For Example, stocks represent ownership in companies and offer the potential for high returns but also come with higher risk. On the other hand, bonds involve lending money to governments or corporations in exchange for regular interest payments.

The concept of asset classes is essential to diversification, which involves spreading one’s investments across different asset classes to reduce risk.

4. What is a New Asset Class?

A ‘new asset class’ refers to an investment category distinct from traditional asset classes such as stocks, bonds, and real estate. It is designed to offer unique risk-return profiles and investment opportunities, often filling gaps in the market between existing asset classes.

5. Introducing new asset class to bridge the gap between Mutual Funds and PMS

SEBI has proposed introducing a new asset class to fill the gap between MFs and PMS. The new asset class offers a regulated product featuring greater flexibility, higher risk-taking capability, and a higher ticket size (minimum investment size) to meet the needs of emerging investors.

For Example, Consider Mr Aman, who has been investing in Mutual Funds with a minimum investment of Rs 5,000. Now, he wants higher returns than what MF offers. However, he finds that PMS requires a minimum investment of Rs 50 lakh[1], which is beyond his current Investment budget. This new asset class has a minimum investment requirement of Rs 10 lakh, making it more accessible for investors.

With this new asset class, Mr Aman can now invest Rs 10 lakh and enjoy higher returns and diverse investment strategies. This opportunity bridges the gap between mutual funds and PMS, providing a viable alternative for investors seeking higher returns.

6. Eligibility Criteria for Mutual Funds/AMCs to offer products under new asset class

SEBI has proposed two routes of eligibility criteria to facilitate existing and newly registered Mutual Fund/Asset Management Companies (AMCs) to offer products under the new asset class. The routes are as follows –

6.1 Route 1 – Strong track record

All the registered mutual funds that fulfil the below-mentioned criteria must be eligible to launch the new asset class –

- Mutual funds must be in operation for at least 3 years and have average assets under management (AUM) of not less than Rs 10,000 crores in the immediately preceding 3 years.

- No action has been initiated or taken against the sponsor/AMC under sections 11, 11B, and section 24 of the SEBI Act during the last 3 years.

6.2 Route 2 – Alternate route

All newly registered and existing mutual funds that do not fulfil criteria under route 1 are also eligible to launch the new asset class, subject to compliance with specific requirements.

- A Chief Investment Officer (CIO) under the new asset class with experience in fund management of at least 10 years and managing AUM of not less than 5,000 crores, and

- An additional Fund Manager for the new asset class with experience in fund management of at least 7 years and managing AUM of not less than 3,000 cr.

- No action has been initiated or taken against the sponsor/AMC under sections 11, 11B, and section 24 of the SEBI Act during the last 3 years.

| Comments |

| The introduction of SEBI’s two routes of eligibility criteria will significantly expand the market for the new asset class, enabling both well-established mutual funds with a strong track record and newly registered and existing mutual funds to participate. This will enhance competition, increase investment options for investors, and promote greater innovation within the mutual fund industry. |

7. Registration and Approval Requirements under New Asset Class

The registration and approval requirements are as follows –

7.1 Trustees/sponsors of MF must file an application with SEBI for providing services under the New Asset Class

The trustees/sponsor of a mutual fund must file an application, along with non-refundable application fees, with SEBI to provide services under the new asset class, along with the required undertakings and documentation.

7.2 SEBI must provide approval to applicants to commence operations under the New Asset Class

SEBI, upon being satisfied that the applicant fulfils the necessary requirements, must provide its approval to the applicant to commence operations under the New Asset Class.

7.3 Two-Stage Registration Process for New Asset Class

The registration process for new asset class must be a two-stage process, consisting of in-principle and final approvals, similar to the registration process followed for Mutual Funds.

7.4 Sponsor of the Mutual Fund doesn’t need to maintain separate net worth or infrastructure for the New Asset Class

The sponsor of a Mutual Fund doesn’t need to maintain segregated net worth or infrastructure, specifically for the New Asset Class. Instead, the New Asset Class represent an additional service offered under the existing mutual fund framework.

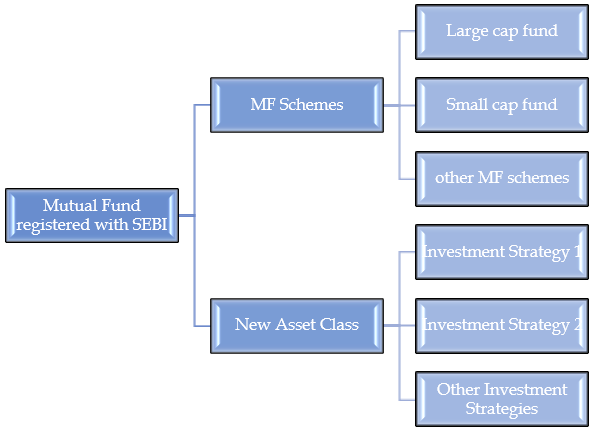

For Example – instead of schemes (like large cap, small cap and other MF schemes) that mutual funds provide, the New Asset Class will offer ‘investment strategies’.

| Comments |

| This streamlined registration process encourages mutual funds to diversify their offerings by making introducing innovative new asset classes easier. Using their existing resources and infrastructure, funds can quickly respond to emerging market trends, broadening investment opportunities for investors and promoting greater innovation in the financial sector. |

8. Minimum Investment Threshold under New Asset Class

The minimum investment amount under the New Asset Class is proposed to be Rs 10 lakh per investor within the AMC/MF. This means an investor must invest a minimum of Rs 10 lakh across one or more investment strategies under the New Asset Class offered by an AMC/MF. This threshold will deter retail investors from investing in this product while attracting investors with investible funds between Rs 10 lakh and Rs 50 lakh.

Further, investors may also have an option for systematic plans such as Systematic Investment Plans (SIP), Systematic Withdrawal Plans (SWP), and Systematic Transfer Plans (STP) for investment strategies under the New Asset Class.

Also, an investor’s total invested amount should never fall below Rs 10 lakh due to investor actions, such as withdrawals or systematic transactions. However, it may fall below Rs 10 lakh due to a decrease in the value of investments.

| Comments |

| This requirement will help to maintain a higher quality of investment, ensuring that the asset class remains attractive to more investors and enhancing overall market stability. It will also deter retail investors, thereby protecting the interests of serious investors. |

9. Defining the structure of the New Asset Class

SEBI has proposed to define the overall structure of the New Asset Class, which is as follows –

9.1 AMCs can offer investment strategies under the New Asset Class

Under the New Asset Class, the AMC can offer ‘investment strategies’ under a pooled fund structure similar to MF schemes. This nomenclature is proposed to differentiate between mutual fund schemes currently managed by the AMCs and those under the New Asset Class.

9.2 Flexible Redemption Frequency for investment strategies under the New Asset Class

The redemption frequency of these investment strategies can be tailored (i.e. daily/weekly/monthly/quarterly/fixed maturity) based on the nature of investments. This flexibility allows the investment manager to effectively manage the fund’s liquidity without imposing undue restrictions on investors.

9.3 AMCs to implement notice or settlement periods for redemption from funds to protect investors

AMCs may implement appropriate notice or settlement periods for redemption from these funds to protect the interest of investors.

9.4 Listing Investment Strategy units on recognized stock exchange

The units of the investment strategies may also be listed on the recognized stock exchange, particularly for units of investment strategies with a redemption frequency greater than a week.

9.5 AMCs must not launch an investment strategy unless approved by trustees

The AMCs must not launch an investment strategy unless approved by the trustees and subject to SEBI’s issuance of final observations on the offer documents.

9.6 Offer document provisions to align with Mutual Fund Schemes

Unless specified otherwise, all provisions regarding the offer documents must be on par with those of Mutual Fund schemes.

9.7 SEBI-specified investment strategies to be launched under the New Asset Class

Only ‘investment strategies’ that SEBI specifies from time to time can be launched under the New Asset Class. Some investment strategies that can be permitted are long-short equity funds and inverse exchange-traded funds (ETFs).

‘Long-short Equity Fund’ is a fund that seeks to deliver returns by taking long and short positions in equity and equity-related instruments. For Example, the fund may be bullish on the automobile sector and bearish on the IT sector, and it may invest in both these sectors by going long on the automobile sector and short on the IT sector. An inverse ETF is a fund that seeks to generate returns that are negatively correlated to the returns of the underlying index.

| Comments |

| The proposed structure for the New Asset Class will offer greater flexibility in investment strategies and redemption frequencies, enhancing liquidity management and investor protection. By permitting some investment strategies, it aims to expand the options available to investors, ensuring a more diverse market. |

10. Branding and Advertising for New Asset Class to ensure clear distinction from traditional Mutual Funds

As the products offered under the New Asset Class will be relatively riskier than the schemes provided by the traditional Mutual Funds, it is essential to maintain a clear distinction between the branding of products under the New Asset Class and those under the traditional Mutual Funds.

Accordingly, it has been proposed that the New Asset Class must be positioned as a product distinct from the traditional Mutual Funds in terms of branding and advertising, including using the sponsor/AMC’s brand or logo. This distinction can be achieved by using specific names and disclaimers in advertisements for the New Asset Class products.

This clear distinction is essential to prevent any potential misconduct or failure in the performance of the New Asset Class from causing brand contamination or undermining the confidence and trust in traditional Mutual Funds.

| Comments |

| This measure will help to maintain investor confidence and trust in traditional Mutual Funds by ensuring that any potential misconduct or performance issues in the New Asset Class do not cause brand contamination. This clear distinction safeguards the reputation and reliability of traditional Mutual Funds. |

11. Proposed relaxations to the investment restrictions for New Asset Class

Schedule VII of the SEBI (Mutual Funds) Regulations, 1996 provides restrictions on investments for Mutual Fund schemes. Additionally, SEBI’s Master Circular for Mutual Funds also provides certain restrictions on investments by Mutual Funds. However, for the New Asset Class, the proposed relaxations to the investment restrictions are as follows –

| S.No. | Particulars | Existing limits under MF Regulations | Proposed limits for New Asset Class |

| 1. | Minimum investment size | Rs 500 (some MFs also accept SIP as low as Rs 100) | Rs 10 lakh per investor across investment strategies at the level of New Asset Class within AMC/MF |

| 2. | Single issuer limit for debt securities[2] | 10% of NAV (can be extended to 12% of NAV with prior approval of trustees and AMC Board | 20% of NAV (+5% with approval of trustees and AMC Board) |

| 3. | Credit risk-based single-issuer limit for debt securities[3] | AAA – 10% AA – 8% A & below – 6% of NAV (+2% of NAV with the prior approval of trustees and AMC Board) |

AAA – 20% AA – 16% A & below – 12% of NAV (+5% of NAV with the prior approval of trustees and AMC Board) |

| 4. | Ownership of paid-up capital carrying voting rights[4] | 10% | 15% |

| 5. | Percentage of NAV in equity and equity-related instruments of any company[5] | 10% | 15% |

| 6. | Investment in REITs and InvITs [6] | Single issuer limit at MF across all schemes – 10%

No MF scheme shall invest more than 10% of its NAV in units of REITs and InvITs and more than 5% of its NAV in units of REIT and InvIT issued by a single issuer. |

Single issuer limit at New Asset Class level across all investment strategies – 20%

No scheme shall invest more than 20% of its NAV in units of REITs and InvITs and more than 10% of its NAV in units of REIT and InvIT issued by a single issuer. |

| 7. | Sector-level limits for debt securities | 20% in a particular sector | 25% in a particular sector |

| 8. | Derivatives | Allowed only for hedging and portfolio rebalancing. | May also be allowed to take exposure. |

| Comments |

| The proposed relaxations for the New Asset Class will significantly increase investment limits and flexibility for investors and fund managers. This includes higher minimum investment sizes, increased limits for single issuers, and broader allowances for debt securities and derivatives. These changes are expected to enhance investment opportunities and portfolio diversification, leading to higher returns, although with increased risk. |

12. Investment in derivatives allowed for market exposure under the New Asset Class

The investment strategies under the New Asset Class may involve investing in derivatives or derivative strategies to gain market exposure. The cumulative gross exposure through all investable instruments, including derivatives and any other instruments as SEBI may permit, must not exceed 100% of the net assets of the investment strategy.

Further, the total exposure via exchange-traded derivative instruments must not exceed 50% of the net assets of an investment strategy. The total exposure via derivatives of a single stock must not exceed 10% of the net assets of an investment strategy.

13. Conclusion

These measures aim to enhance flexibility, increase investment opportunities and offer higher risk-taking capabilities, thereby attracting investors seeking more investment strategies. By implementing eligibility criteria and minimum investment thresholds, SEBI intends to curb unregistered schemes and protect investor interests. The proposed relaxations to investment restrictions for new asset class and clear branding and advertising will maintain a distinct identity and prevent confusion with traditional Mutual Funds. These initiatives are expected to boost a more innovative and secure investment environment. Comments on the same may be submitted by August 6, 2024.

[1] Press Release No. 24/2019; Dated: 20.11.2019

[2] Regulation 44(1) read with Clause 1 of Seventh Schedule of SEBI (Mutual Fund) Regulations, 1996

[3] Master Circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2023/74; Dated: 19.05.2023

[4] Clause 2 of Seventh Schedule of SEBI (Mutual Fund) Regulations, 1996

[5] Clause 10 of Seventh Schedule of SEBI (Mutual Fund) Regulations, 1996

[6] Clause 13 of Seventh Schedule of SEBI (Mutual Fund) Regulations, 1996

The post [Analysis] SEBI’s New Asset Class | Bridging the Gap between Mutual Funds and PMS appeared first on Taxmann Blog.